To meet ever-growing consumer data demands and offer new digital products and services, European telcos are strongly investing in high-speed fibre broadband.

European fixed telecom providers are joining forces through co-investments projects and network sharing agreements, to accelerate coverage and reduce the costs of fibre deployment.

For instance, Vodafone and Orange agreed in April 2019, to grant shared access of their future fibre networks to both operators in Spain.

Furthermore, European telecom regulators and governments are also encouraging and incentivising fibre deployment. For instance, the French regulator, ARCEP, announced a ‘fibre zone’ initiative in December 2018 to stimulate the migration from copper lines to fibre broadband.

Additionally, the Italian government is planning to provide subsidies in a voucher scheme, of up to US$3,423 to small and medium enterprises, and up to US$5,705 to schools, when migrating fixed broadband to the fibre-optic network. Furthermore, the Italian government also incentivises fibre deployment in less profitable areas such as rural areas or areas with a low population density.

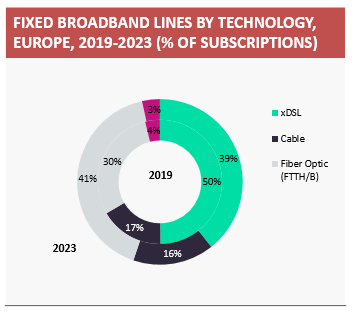

xDSL is the leading fixed broadband technology, accounting for 49.9% of total fixed broadband lines in 2019. Fibre will grow at a CAGR of 12.4% over 2019-2024 and will become the leading fixed broadband technology by 2023, surpassing xDSL as shown in the graph below.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn Europe, Russia has the highest share of fibre lines as a percentage of total broadband lines, amounting to 75% in 2019. However, Spain’s fibre market is expected to take the lead in Europe and outrank Russia by 2024, with an 86.5% share of total broadband lines.

Related Company Profiles

Orange SA