With both Swisscom and Sunrise Switzerland having already launched commercial mobile 5G services in April 2019 and BT UK having done the same at the end of May, the question on everyone’s minds is: will 5G be more expensive than 4G in Europe?

How much will 5G cost?

The simple answer is: customers will end up spending more but not necessarily for the same services.

At the start of the 4G era, to monetise their network investments, telcos focused mainly on selling mobile data bundles, and in a number of cases, with no price premium vs 3G. What happened next was the emergence of Over-the-Top (OTT) players – e.g. Netflix, Amazon Prime, Messenger and WhatsApp – which run on top of telcos’ mobile data networks. These OTT players have been capturing revenue streams from end-customers and from advertising.

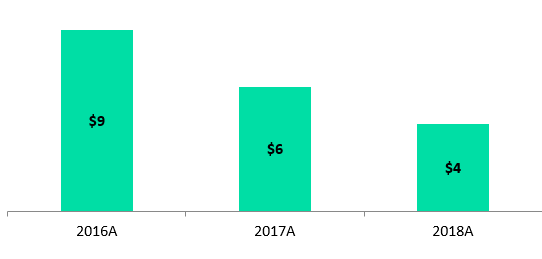

Telcos could have captured such revenues had they entered the OTT applications space successfully, to further monetise their 4G networks, most telcos have started selling larger mobile data allowances at more affordable prices, which has resulted in the commoditisation of the mobile gigabytes. GlobalData estimates that the average monthly revenue telecom operators generate from a 1GB of mobile data declined dramatically by US$5 in 2016-2018.

Average revenue generated by European Telcos for 1GB of mobile data (US$)

With 5G, operators want to steer away from their previous 4G positioning and try to get the most out of their 5G investments. As such, a number of monetisation moves are expected, including a) applying a price premium on 5G vs 4G and b) bundling 5G with additional benefits – e.g. value-added-services and OTT applications – directly built and priced into the 5G plan.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSwisscom Switzerland, for instance, is charging a CHF10/US$10 premium to mobile users wanting to activate 5G on their plans.

Another example comes from BT UK. The telco has announced that 10GB of 5G mobile data will sell at £54/US$69, including two value-added services to be chosen from the following: an HD HDR version of the BT Sports pass, gamers data pass, music data pass, EE video pass and roaming.

Such a move can help telcos boost their revenues by increasing customers’ data usage and going beyond selling GBs to selling the service that runs on top of it. Telcos will be able to achieve this through partnerships with existing OTT and content players to bring video, gaming and music content to their customers.

In sum, with the introduction of 5G, consumers spend on mobile data bundles will most likely increase as telcos seek to boost data usage and monetise more premium speeds and content around video, sports, gaming and music.

Related Company Profiles

Swisscom Ltd

Netflix Inc