Early forecasts for the IoT suggested that there would be 50 billion global devices connected by 2020, but in reality we have only reached about 2 billion. Let’s look at why the Internet of Things isn’t growing as rapidly as predicted.

In 2010, we started to see huge excitement about the IoT from a diverse ecosystem of suppliers, ranging from operators and mobile virtual network operators (MVNOs) to infrastructure vendors, module manufacturers, integrators, and solution providers. Early forecasts from companies such as Cisco and Ericsson suggested that by 2020 we would see from 20-50 billion devices connected.

What went wrong?

Initial suggestions were based on the assumption that once we had ubiquitous global connectivity, everything that could be connected would be connected. In the consumer market, projections were based on a huge rise in the number of connected cars (which we did in fact see), as well as in segments such as consumer electronics, wearables, smart watches, smart cities, and health monitoring devices. In the business segment, utilities, insurance, retail, industrial fleets, and manufacturing were (and still are) the primary verticals assumed to significantly benefit from IoT connectivity. The opportunity for IoT was also supposed to be global – not only from local/regional deployments across the world, but also from inter-country deployments where connections required roaming agreements and single-SKU global SIMs.

While the industry remains optimistic about the growth of the IoT, these early projections have been rolled back considerably. Issues about lack of data security, cost of deployment, lack of company expertise, the need to have buy-in from multiple constituencies as well as belief in a solid ROI from upper management – have all emerged as reasons why the Internet of Things isn’t growing as rapidly as predicted. Cities with stretched budgets and lack of centralized systems for security, parking, lighting, water management, etc. have struggled to embrace of IoT. Operators are also struggling to monetize their IoT investments. Average revenue per user (ARPU) is notoriously low, and roaming fees have become much lower due to EU regulations, deterring excitement about global deployment.

What has gone right?

It’s not a totally dismal picture even if early forecasts were too optimistic. For example, some segments have grown beyond expectations while unanticipated new use cases have emerged. Some pilots have grown to large deployments and new connectivity types and technologies will continue to be enablers of growth. Particular regions, such as Asia Pacific, are seeing large increases in IoT connections due to government sponsorship and the desire to excel in technology products, including use of connected robotics and other types of industrial automation.

Global connectivity has improved due to: global SIMs and eUICC technology, which provide, respectively, single SKUs for devices regardless of where they are located, and embedded SIMs offering remote management and the ability to change networks while goods or fleets are in transit. Permanent roaming agreements and EU roaming fee caps also make roaming easier and less expensive. Connectivity management platforms are mature and provide connection and device management and visibility, as well as provisioning, billing and other BSS functions for mobile operators. Connectivity has become less expensive as NB-IoT and LTE-M networks were launched in 2017/2018 which increase battery life of devices and lower the cost of modules.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAlong with edge computing, 5G is expected to stimulate “massive” IoT connectivity because the opportunity to provide real-time, low latency connectivity with high availability and reliability (and in future, network slicing) will drive new use cases in verticals from healthcare to manufacturing, smart grid, smart cities, private networks, and autonomous vehicles. AR and VR are expected to become widespread in consumer and business segments, while autonomous vehicles, which are highly dependent on 5G and require ultra-low latency, are in pilots across the world.

What are the new “right-sized” forecasts for IoT?

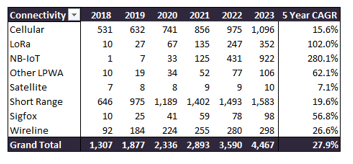

GlobalData’s forecast for IoT Connections predicts that by 2023, there will be approximately 4.5 billion connections, of which the majority will be from cellular (2G/3G/4G/5G), LPWAN (LoRa, NB-IoT, LTE-M) and short-range network types (including WiFI, Bluetooth, and Zigbee). The CAGR during the period from 2018 to 2023 will be 27.9%, with LPWANS seeing the highest growth rates.

GlobalData’s forecast for the IoT predicts that by 2023, there will be approximately 4.5 billion connections.

While this isn’t as impressive as some of the earliest forecasts for IoT, it still represents a significant growth opportunity for the supplier ecosystem, which not only supplies connectivity, but also a wide variety of additional software, equipment, consulting, deployment and integration services, and end-to-end solutions, In addition the advent of ubiquitous 5G towards the end of the period will drive further adoption, as will the overcoming of many of the initial objections of business customers. New security solutions and help for business customers in achieving satisfactory ROI needs to be part of the growth plan for vendors and operators.