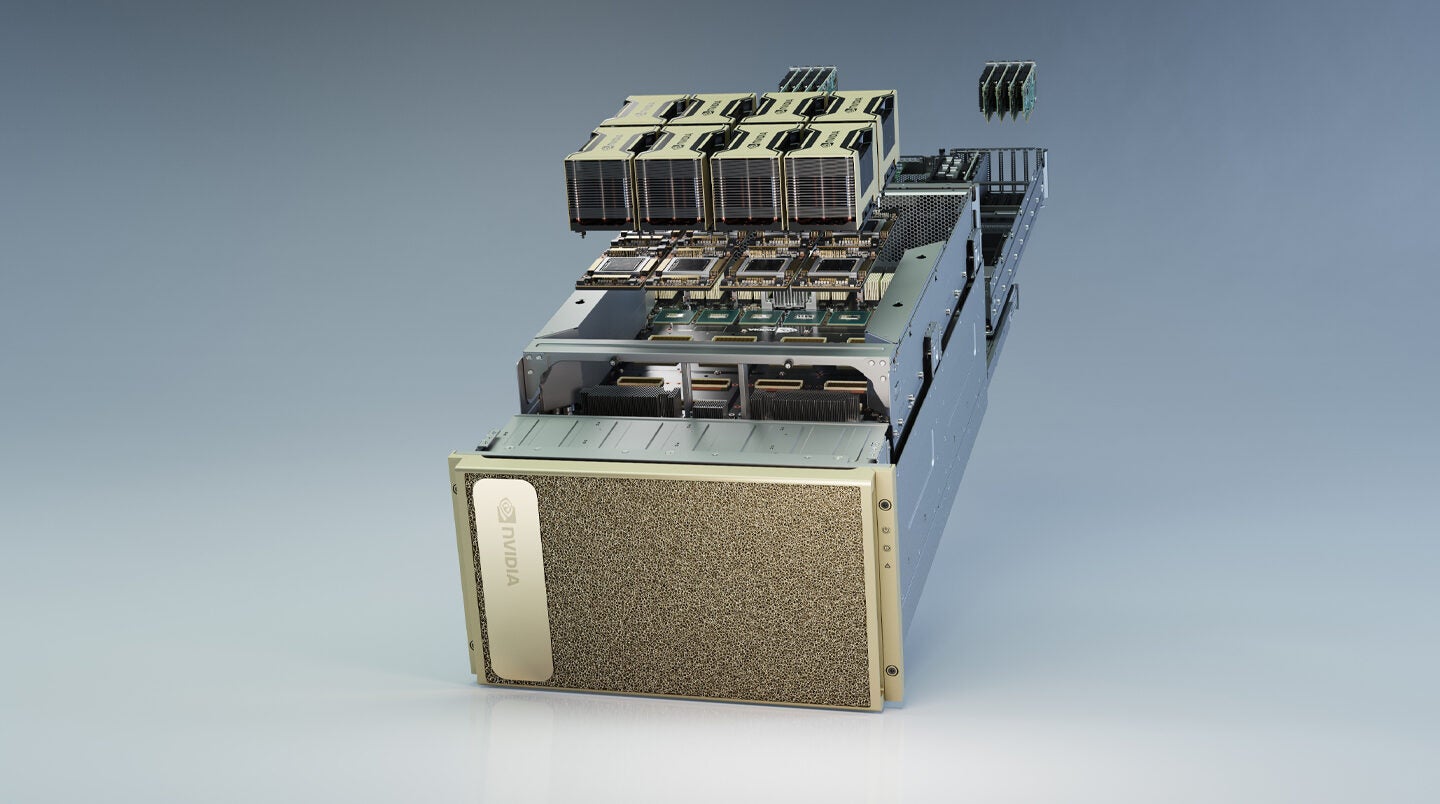

Sales of NVIDIA’s data centre technology soared by 167% from a year ago as the chipmaker capitalised on strong demand for graphics processing units (GPUs) during Q2.

The US company reported Q2 data centre revenues of $1.75bn, up 54% from the previous quarter and an all-time high. It marks the first time Nvidia’s data centre revenues have surpassed those from its gaming business.

Nvidia’s overall revenue for the quarter ended 26 July was $3.87bn, up 50% year on year and up 26% from the previous quarter and also beating previous revenue records.

Nvidia also saw strong sales for its gaming segment, with Q2 revenues of $1.65bn – up 26% from a year ago.

Analysts had expected a strong quarter due to the pandemic’s stay-at-home measures fuelling demand for gaming and data centre technology. Even so, Nvidia beat Wall Street expectations, which had predicted revenues of $3.65bn.

There are signs that Nvidia’s acquisition of network product maker Mellanox Technologies, finalised in April, is already providing returns. In Q2 the company contributed to 14% of Nvidia’s overall revenue. However, one-time costs associated with the deal ate into Nvidia’s profits for the quarter, which came in at $622m using GAAP accounting rules.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“Adoption of Nvidia computing is accelerating, driving record revenue and exceptional growth,” said Jensen Huang, founder and CEO of Nvidia, in a statement. “Growth in GeForce gaming accelerated as gamers increasingly immerse themselves in realistic virtual worlds created by NVIDIA RTX ray tracing and AI.

“Our new Ampere GPU architecture is sprinting out of the blocks, with the world’s top cloud service providers and server makers moving quickly to offer NVIDIA accelerated computing. Mellanox grew sharply, driven by the need for high-speed networking in cloud data centres to scale-out AI services.”

Nvidia Q2 results: Automotive slump

Nvidia demonstrated in Q1 that it is resilient to the economic damage of the pandemic. However, not all segments saw growth in Q2.

Nvidia, which provides GPUs used in autonomous vehicles, saw its automotive revenues fall 47% from a year ago to $111m. However, a deal to integrate Nvidia’s autonomous driving software and hardware into all its vehicles, announced in Q2, will provide a future boost to the segment from 2024.

The company’s professional visualisation segment, which includes virtual reality technologies, saw Q2 revenues fall 30% from a year ago to $203m.

“Despite the pandemic’s impact on our professional visualization and automotive platforms, we are well-positioned to grow, as gaming, AI, cloud computing and autonomous machines drive the next industrial revolution around the world,” said Huang.

For the third quarter, Nvidia expects revenues of $4.4bn with a 2% error margin. Nvidia’s share price is up by more than 100% since the start of the year.

Nvidia is reportedly in talks to buy British chipmaker Arm, which could help it compete with Intel and AMD in the CPU space.

Read more: Nvidia is poised to become an edge computing market leader