Numbrs Personal Finance AG, a Zurich-based financial technology (fintech) company, backed by the sovereign wealth fund Investment Corporation of Dubai (ICD), has reached $1bn in valuation making it Europe’s latest unicorn, news agency Bloomberg has reported.

A unicorn is a privately held startup company valued at over $1 billion. It is understood the most recent investment of $40m has brought the total capital invested in the firm to almost $200m, Bloomberg said citing Numbrs CEO Martin Saidler.

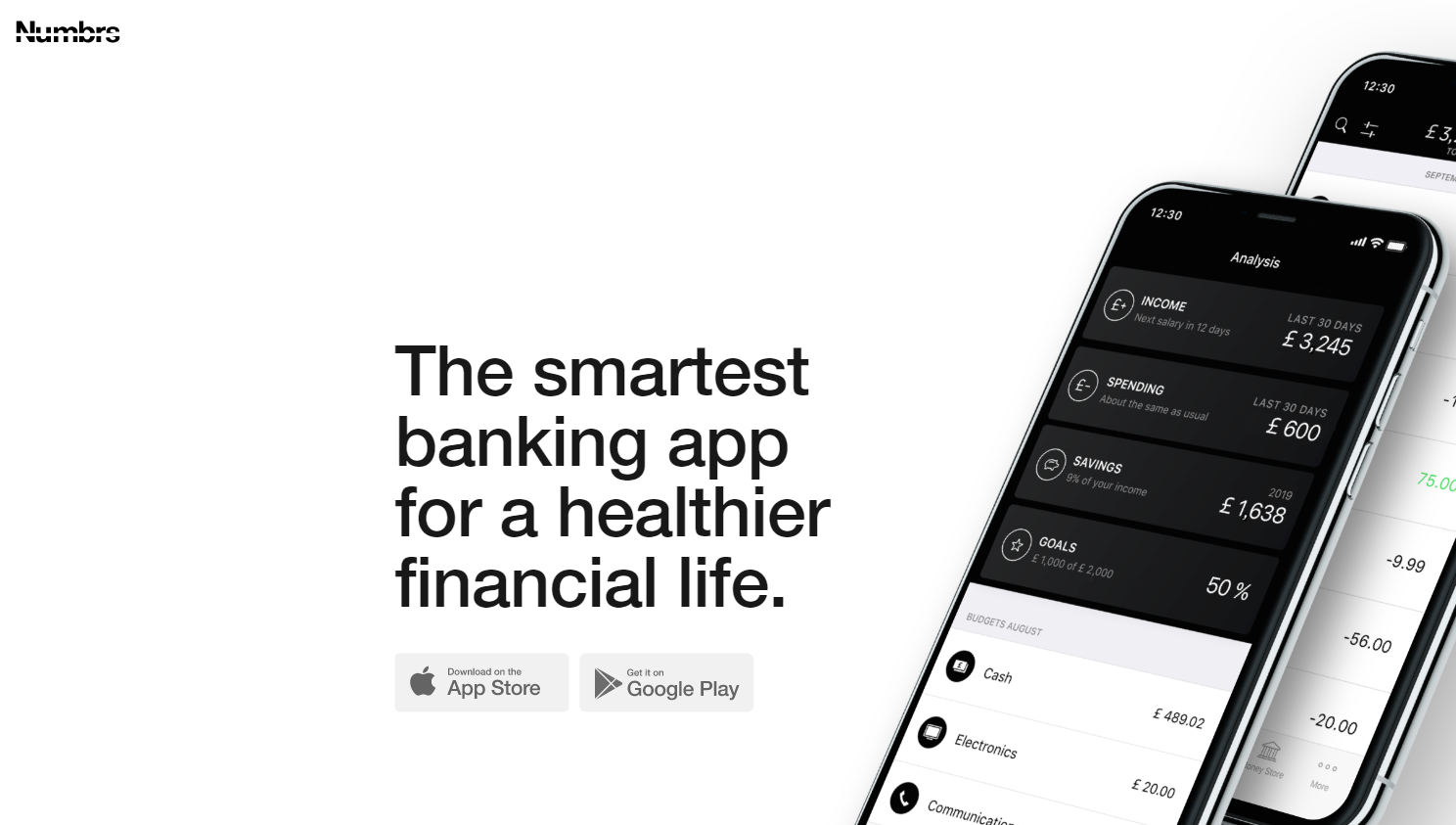

The firm plans to use the latest fund-raising to support expansion plans beyond Germany, particularly into the UK. Available as an app, Numbrs helps users to “manage their existing bank accounts, credit card information, and conduct mobile banking along with personal financial planning.”

MEED understands the app has had over two million downloads and has an estimated $11.1bn in managed assets.

In addition to ICD, more than 50 individuals and families have invested in Numbrs. They include Josef Ackermann, former CEO of Deutsche Bank; Ronald Cohen, co-founder of Apax Partners and Bridges Fund; and private banker Pierre Mirabaud.

“Venture capital and private equity funds tend to have less patience. They get nervous when it takes longer for a start-up to earn money,” Saidler said, who expects the firm to break even in two years.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMEED

This article is sourced from Verdict Technology sister publication www.meed.com, a leading source of high-value business intelligence and economic analysis about the Middle East and North Africa. To access more MEED content register for the 30-day Free Guest User Programme.

Related Company Profiles

Bloomberg LP

Deutsche Bank AG