Russia’s finance ministry and central bank are butting heads over whether to ban cryptocurrencies or not, but cyber criminals should be worried no matter the outcome.

In January, the Central Bank of the Russian Federation proposed that Russia should ban digital currencies, sparking warnings about an imminent cryptocurrency winter around the world. The Bank argued that cryptocurrency trading and mining threaten financial stability and that they should therefore be banned.

However, the finance ministry has indirectly challenged the proposals, instead suggesting that Russia should introduce regulations to better police cryptocurrencies and to create a market for the asset class. These rules would accept that cryptocurrencies could be used as investment tools, but not as means of payment.

The dispute took another turn on Friday when the finance ministry submitted its proposals. On Monday, the ministry said it would take the central bank’s views under consideration, Reuters reported.

Ban or not: stricter rules are coming

While the finance ministry’s touch is softer than the outright ban proposed by the Bank of Russia, the proposals would still put an end to the Wild West of cryptocurrencies in the country.

For instance, the proposals would force foreign exchanges to get a licence and to pay taxes.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCustomers would also have to submit to stricter rules if the finance ministry gets its way, including taking financial literacy tests to determine how much they would be permitted to invest.

Citizens who pass the test would be permitted to invest up to 600,000 roubles ($7,853) in digital currencies each year while those failing could only invest about $650 annually.

Customers would also have to submit to customer identification processes. Know your customer (KYC) processes are a hotly debated issue in cryptocurrency circles.

One camp argues that KYC would eliminate one of the major selling points of digital currencies: the ability to make transactions anonymously without central oversight.

The second camp equally vehemently argues that introducing identity checks is the only way for cryptocurrencies to be taken seriously and reach widespread adoption. Several financial market stakeholders share this sentiment.

The British National Bureau of Economic Research, for instance, published research in October 2021 that demonstrated how low-KYC exchanges were often used to launder money, making it difficult for law enforcement agencies to pursue criminals. The consequence of this is that bitcoin exchanges with lax KYC “serve as a gateway for money laundering and other gray activities.”

Hackers in Russia benefit from cryptocurrencies

Cyber criminals in Russia are likely to closely watch the ongoing debate about cryptocurrency legislation. Bitcoin, ether and other forms of digital money are frequently used by ransomware gangs to get paid for their hacks.

Seventy-four per cent of all money stolen through ransom demands in 2021 went to threat actors linked to Russia, according to recent research from Chainalysis. The market research firm estimated that more than $400m worth of cryptocurrencies had flowed into Russia from these illicit activities.

The research also suggested that several Russian cryptocurrency companies were used to launder dirty money.

Vladimir Putin’s regime has repeatedly denied harbouring cyber criminals.

Is a cryptocurrency winter coming?

A potential ban of cryptocurrencies in Russia has been linked to the recent downturn of the blockchain money market, but other factors have also exacerbated the asset class’ plummeting value.

Bitcoin, ether and even meme coins like dogecoin enjoyed skyrocketing valuations over the past two years.

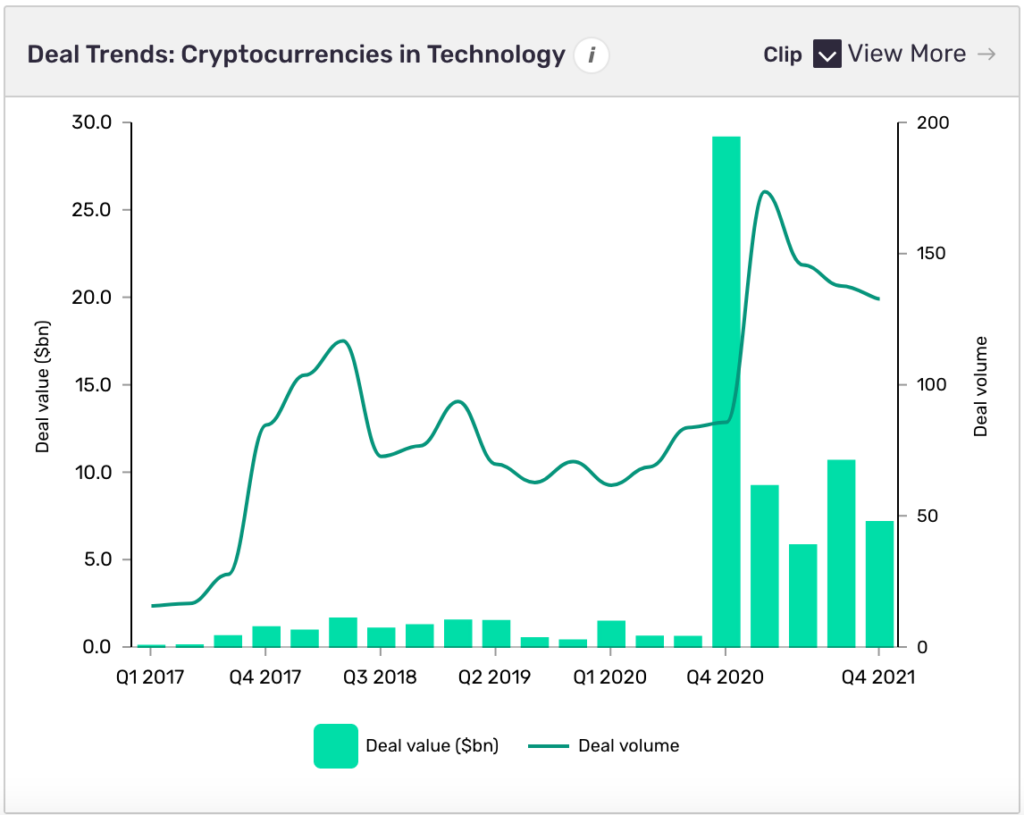

At the same time, the number of funding deals into the cryptocurrency industry jumped too. The 298 venture financing, M&A and public funding deals recorded in the sector had a total value of $3.9bn in 2019, according to analyst firm GlobalData’s data.

Those numbers jumped to 301 deals worth $31.787bn in 2020.

While bitcoin reached an all time high above $69,000 in November last year, digital dosh in general has had a rough start to 2022. The cryptocurrency market lost over $1tn in value in January.

The drop has been attributed to several factors, not just the threat of a ban in Russia and stricter policing from other regulators around the world who have made similar proposals.

Other contributing factors include the growing political tensions in Ukraine, the US Federal Reserve being expected to raise its interest rate and put a stop to its pandemic spending policies, and simply the fact that social restrictions are easing up, meaning people have less time to invest in digital assets.

GlobalData is the parent company of Verdict and its sister publications.