South Korea, home to leading memory chipmakers Samsung Electronics and SK Hynix, has long been a dominant force in the global semiconductor market.

In 2023, the country announced plans to establish the world’s largest chip centre, backed by $456bn in private investment.

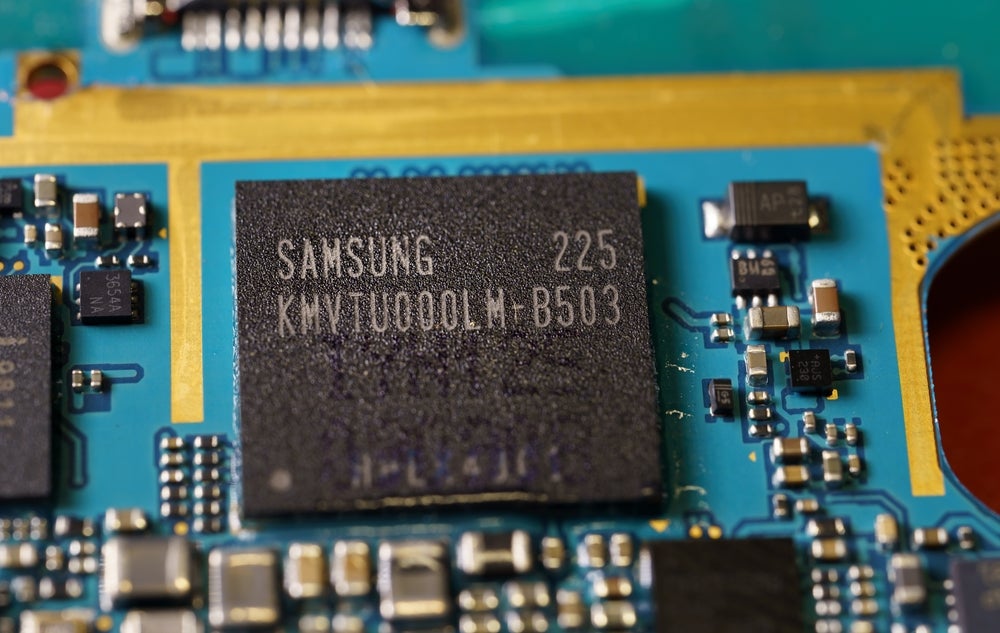

Currently, South Korea leads the production of DRAM and NAND memory chips, which are essential for managing and storing data on PCs, smartphones, and SD cards, commanding over 60% of the market share. The nation now aims to expand its presence in the production of other types of chips and processors, further strengthening its position in the semiconductor industry.

The South Korea plan and industry measures

In 2024, South Korea unveiled a significant $19bn investment package to bolster its semiconductor industry. Described by the government as a response to “all-out warfare” in the global semiconductor market, this initiative underscores the country’s commitment to maintaining its competitive edge. The plan comes amid the ongoing US-China rivalry, which has increasingly complicated supply chains, especially in the chip market.

To support its ambitious goals, the South Korean government has proposed several measures, including tax incentives for investments and initiatives aimed at boosting competitiveness. A key objective is to increase self-sufficiency in essential materials, parts, and equipment for chip production to 50% by 2030.

Samsung Electronics is facing challenges

Amid all the initiatives and planning, Samsung Electronics, one of the leading chip makers in South Korea is currently facing numerous challenges.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe National Samsung Electronics Union (NSEU), which represents over a fifth of the industry’s workforce, announced an unprecedented strike for June 7 2024, to demand higher wages, additional leave, and transparent bonuses. This labour unrest coincides with broader issues, including Samsung’s declining competitiveness in advanced semiconductor technology, ongoing legal battles involving its chairman, and a slump in its share price.

Although Samsung previously enjoyed record profits, the company is now struggling due to a global economic slowdown affecting memory chip sales. Additionally, internal disagreements among Samsung’s various labour unions further complicate the situation, as some question the motives behind the strike.

Moving forward in a competitive landscape

South Korea’s semiconductor industry faces uncertainty amid these multifaceted pressures. To navigate these challenges, Samsung and other South Korean chipmakers must focus on innovation and diversify their chip production capabilities.

Enhancing labour relations and ensuring transparent negotiations with unions will also mitigate internal conflicts. By maintaining strategic investments and fostering collaboration between the government and private sector, South Korea can solidify its leadership in the global semiconductor market and drive future growth.

Related Company Profiles

Samsung Electronics Co Ltd

SK Hynix Inc