T-Mobile USA, the self-styled ‘Un-carrier’ and fearless wireless market disruptor – and the only US carrier to demonstrate any meaningful growth in the wireless market over the last couple of years – is training its guns on the lucrative cable and TV market, using long-term evolution (LTE) and eventually 5G.

T Mobile Uncarrier 2019

In true Un-carrier style, the operator has issued a brash press release promising to disrupt “one of the most un-competitive and un-customer friendly industries in existence” and save US consumers billions of dollars in the process by encouraging them to ‘cut the cord’ and move all their household broadband expenses to an all-wireless solution.

T-Mobile USA’s logic is sound. Cable and TV bundle monthly fees, as US consumers well know, haven’t seen much pricing competition in recent years – and certainly not compared to the wireless market.

A standard monthly household bill can easily top $100 or more a month, especially when extra mobile plans are added in. Since most US carriers are currently attempting to shift their marketing and strategy energy towards the promotion of fixed-and-mobile bundles, to replicate the same ‘convergence’ strategy that has seen moderate success in Europe, the number of households with an excessively large consolidated bill to meet every month has increased.

T-Mobile USA has further promised to create an offer which directly addresses some of the largest customer pinch-points in the US cable market: long-term annual service contracts which are both costly and difficult to exit as well as the hidden fees and equipment costs that often serve to inflate the monthly bill.

In the immediate term, the offer will be 4G-only and will be positioned as a limited pilot, targeting just 50,000 homes this year in rural and underserved areas of the country. But the Un-carrier warns it plans to cover more than half of US postcodes by 2024 with the capacity for 9.5 million households to cut the cord and switch to 5G as a wireless alternative to fixed broadband, cable or fibre.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCapitalising on ‘bill shock’

Incumbents should certainly take that threat seriously.

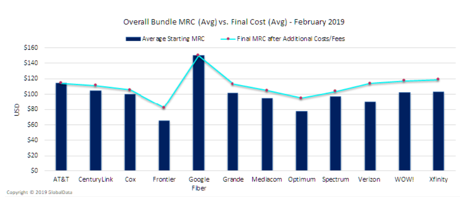

Bill shock, as it is known, is a sore point for many US customers, as the advertised rates for broadband and cable services are often not what the customer sees once all required equipment and mandatory service or technology fees are added.

According to GlobalData’s @Home February 2019 report, the actual cost customers’ see on their bills can be as much as 66% over the advertised rate, once all the extras are added in.

In one example, Xfinity’s $34.99 internet plus basic bundle (60 Mbps internet plus limited basic) jumps to a whopping $57.99 to $62.94 per month (price varies by location) once the additional $13 internet equipment and $10 HD technology fee costs are added into the mix.

It is likely we will see quite a bit of pricing revision in the coming months, as the fixed broadband incumbents revise their pricing strategies to anticipate the threat of T-Mobile USA in the home services market.