With towers off their balance sheets, telcos can enjoy reduction in capex related to maintaining and developing towers, freeing up funds. Such moves, may also be encouraged by investor-led programs to obtain asset monetization to reduce selected telcos’ high debt and increase share valuations.

As well, by attracting investment in their towercos, pooling their assets and co-investing in towercos, MNOs can achieve their 4G/5G coverage targets faster.

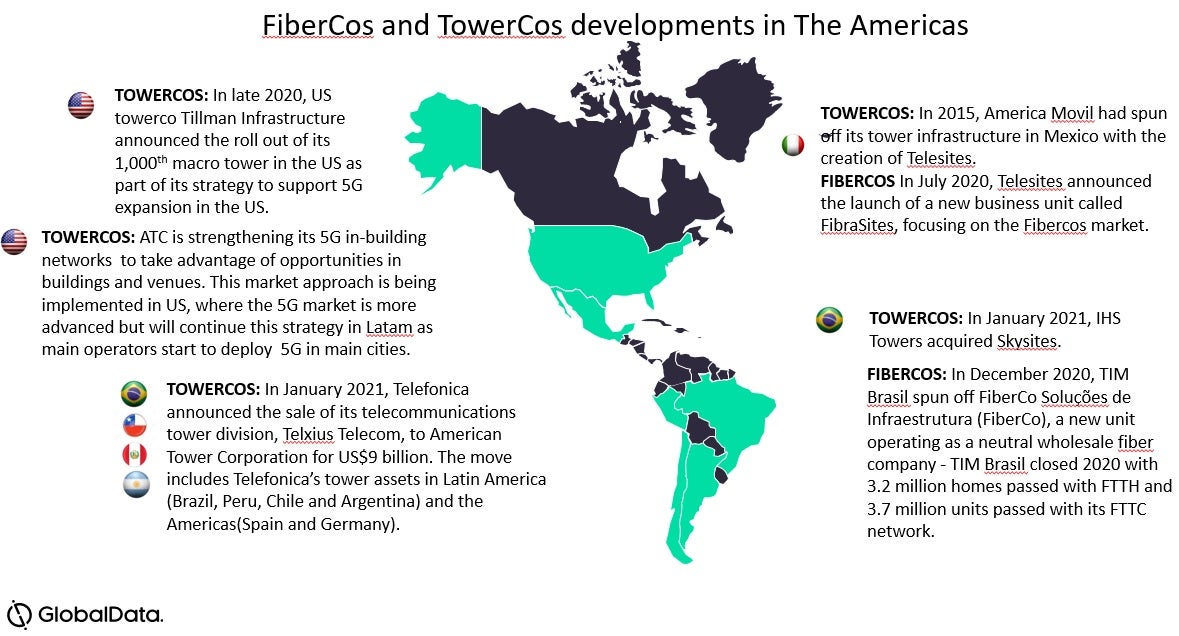

In the Americas Telcos are being very active in the Fibercos/Towercos space. After the sale of Telxius by Telefonica, the subsidiaries of the group in Chile and Peru have created companies with the aim of growing in the Fibercos business, with the particularity that are looking to incorporate investment funds aiming to capitalize the companies and expand Fiber deployments in the country.

The same idea is being developed by Tim Brazil who created FiberCo and is in negotiation process to incorporate capital from IHS towers. The increasing market size and the potential revenue streams make telco movement into the fiberco/towerco space attractive, as it does for an investment fund or other players taking stakes in these fiber and tower businesses.

Monetization may get more challenging in the future, as fibercos and towercos may find themselves in the future competing for a the same pool of traditional renters. As such, their longer term expansion strategy should capture new revenue streams in areas including edge computing, IoT, private networks and attracting a new breed of customers – e.g., data center providers, the vertical industries for private networks, and utilities for IoT smart metering networks.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Telefonica SA