Despite the Ukraine crisis sending shock waves through the fintech community, the industry managed to secure significant investment in February. The 10 biggest deals raised by the sector last month together secured more than $2.093bn. That doesn’t mean the war in Eastern Europe hasn’t been felt by the community.

Russian tanks rolling towards Kyiv and Kharkiv – home cities of the nation’s tech industry and victims of unrelenting bombardment from Vladimir Putin’s troops – have forced politicians and business leaders alike to contemplate the unthinkable: that their role in an active conflict could be bigger than ever before.

The Group of Seven, or G7, has imposed unprecedented punitive economic sanctions against Russia, designed to cripple the regime’s finances and force it to withdraw from Ukraine. Ukraine’s allies have barred Russia and its fintech companies from international payments system SWIFT, cutting them off from secure international communications and transactions.

At the same time, cryptocurrency exchanges have been encouraged to bar people with ties to Vladimir Putin’s regime from using their services, plugging a hole that would potentially have enabled them from circumventing the sanctions. The response has been varied, with some organisations like Binance agreeing to ban named individuals, but refusing to introduce blanket bans against all Russians.

Russia’s invasion of the Ukraine has forced cryptocurrency enthusiasts to reevaluate bitcoin’s reputation as a safe haven asset like gold, with the value of the digital money plunging instead of rising in the face of market uncertainties.

Other sanctions include the US targeting the National Wealth Fund of the Russian Federation and the Ministry of Finance of the Russian Federation. Western investors have also been prohibited from doing business with the Russian central bank and Western nations have moved to freeze its overseas assets, not least the vast foreign currency reserves the CBR has used as a buffer against the depreciation of local assets.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe severity of the sanctions has prompted some commentators to suggest that Ukraine’s allies are now engaged in a financial war with Russia.

The war has changed geopolitical realities too, with both Sweden and Germany now actively delivering lethal weapons to a war zone and the president of the European Commission, Ursula von der Leyen, talking about admitting Ukraine into the EU. None of this would have been imaginable just two weeks ago.

Fintech leaders caught in the crossfire

Business leaders around the globe have been forced to respond to the war. Ukraine is a major producer of neon gas, which is essential in the fabrication of microchips, and hundreds of tech companies around the world outsource to the nation. Consequently, there has been a public outpouring of support by companies to aid the fragile tech community in Ukraine.

As Saar Gur, general partner at venture capitalist firm CRV, put it: “As almost all tech companies have some exposure to [Ukraine and Russia,] every CEO is now a ‘war time’ CEO.”

Fintech leaders have increasingly been asked what the conflict will mean for their companies, prompting buy-now-pay-later (BNPL) giant Klarna’s CEO Sebastian Siemiatkowski to tweet: “We don’t care how it impacts Klarna’s business. It’s irrelevant! If there are any consequences from the war, on Klarna, we are happy to take them, that is the very very least we can do.”

Russian fintech customers have been caught in the blast zone as well. Challenger bank Tinkoff’s shares have plummeted on the London Stock Exchange following Vladimir Putin’s invasion.

The Russian central bank has said that Google Pay and Apple Pay services will not be available to users of cards issued by Russian banks that have been hit by sanctions due to the Ukraine crisis.

“Russia’s invasion is a reminder of banks’ role and influence,” Stephen Walker, fintech analyst at research firm GlobalData, tells Verdict. “One, because rather than tanks and guns, we are mobilising international financial mechanisms to bring an imperial aggressor to task – the SWIFT is mightier than the sword. Two, because this is a historic event, about which many bank customers may have strong feelings, and expect their preferred financial institutions to share those feelings.”

Elsewhere, opportunistic cryptocurrency bros at Fuutur have launched a dedicated platform for people to gamble their digital dosh on how the Ukraine crisis will evolve.

On the other end of the spectrum, cross-border transaction company Wise has suspended payments to and from Russia and UK challenger bank Revolut has waived transfer fees for transactions from Ukraine. The $33bn neobank has also enabled Red Cross donations to help Ukrainians caught in warzone. Revolut’s CEO Nik Storonsky holds a Russian passport and his CTO and co-founder Vlad Yatsenko is Ukranian.

“When I was growing up, the notion of war between Russia and Ukraine was unthinkable,” Storonsky said in a blog, pledging that Revolut would meet the amount donated with donations of its own. “Not just because war, and the loss of innocent lives, is always wrong, but because to me, Ukrainians and Russians are kin.

“I know this because, when Vladyslav and I founded Revolut in London, it did not matter where we came from. It felt like we were two brothers with a purpose and a big vision. And today, it still does.”

Walker notes that few traditional banks have followed suit in the fintechs’ footsteps, apart from saying that they have limited to no exposure to Russia.

“This may be because big banks have more sign-offs to move through before making a comment, or want to do more risk assessment,” Walker says. “Or maybe because they don’t think it’s their place to say anything, for reputational issues, or even fear of Russian cyber attacks as reprisals. But another interpretation is not just that fintech can often move faster, as we saw in response to Covid when dispensing government loans. But also, that maybe they see their role differently.

“There is precedent in the Tech sector for this type of activism. In February 2017, Airbnb came out in response to Donald Trump’s immigration ban by providing free short term housing to 100,000 refugees. It also screened a #WeAccept advert during the Super Bowl, featuring close-ups of faces from different backgrounds. It was a compelling response, and sent the message that when it came to acceptance the company was serious about putting its values into action.

“Russia’s invasion of Ukraine is a much bigger moment and threat to Western liberal ideals than Trump’s immigration ban. UK has already been urged to accept thousands of Ukraine refugees. Will AirBnB do anything here? Or other fintech firms?

“How will this make incumbent banks look if they don’t do anything, or don’t do enough, or don’t do it soon enough? Whether incumbent banks do anything here or not, I do think an ESG lens can help navigate the issues and implications in situation like this.”

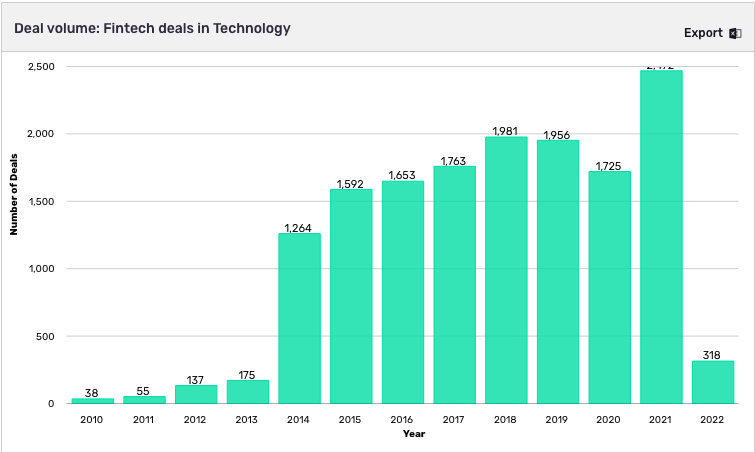

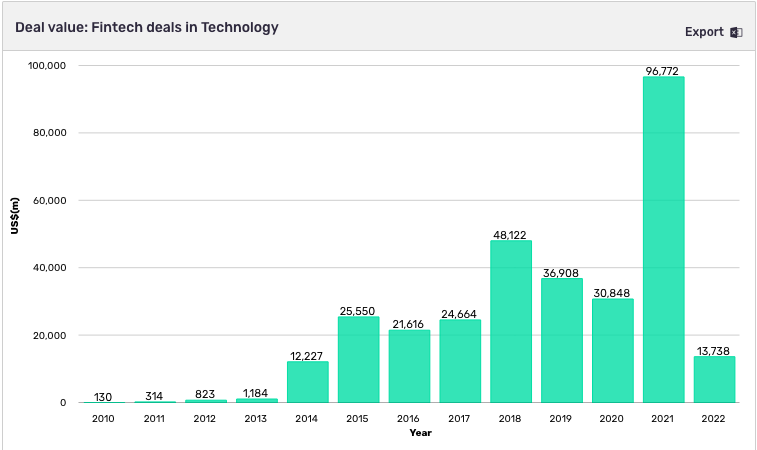

Despite the turmoil, the fintech industry continued to secure massive amounts of funding in February. So far in 2022, GlobalData has recorded 318 venture financing deals worth $13.7bn in the fintech in technology sector. That follows from the record year of 2021 when the sector recorded 2,479 deals worth $96.7bn in total.

With that in mind, let’s take a closer look at the 10 biggest fintech funding rounds closed in February.

Scalapay secures $497m in Series B funding

Italian BNPL startup Scalapay claims to have become the nation’s first unicorn in years after securing a $497m Series B funding round, bringing the grand total raised by the fintech to over $700m. The fintech startup’s February round followed a $155m deal in September 2021. The company was founded in 2019.

Ukrainian crisis aside, the BNPL industry has a lot to worry about. Regulators around the world are increasingly investigating how to police the industry, fearing that leaving it unchecked could see vulnerable customers buried under mountainous debt. At the same time, the stocks of publicly traded BNPL companies like Affirm, Humm and OpenPay have dipped far below their 2021 peaks.

“We will use the funds to expand into new markets and verticals such as travel,” CEO and co-founder Simone Mancini told Verdict. “We’ll also use the financing to expand our team across the EU and continue the development of Magic, our checkout product, and M&A activity.”

Scalapay’s new cash injection comes against a background of huge BNPL growth during the pandemic. The coronavirus crisis accelerated customers’ migration from offline to online shopping. Intimately linked to this shift is the fact that more people also started to use services enabling them to either split or postpone payments, often on ecommerce sites.

As a result, a wealth of BNPL startups such as Zilch have entered the scene. Payment providers Mastercard and PayPal as well as challenger bank Monzo have also launched instalment services over the course of the pandemic.

Analysts expect the sector will be worth $166bn by 2023, according to recent GlobalData thematic research.

Flutterwave bags $250m in Series D cash injection

Africa is often overlooked by European and North American publications. However, they’re doing so at their own peril. Spearheaded by the launch of mobile payments network M-PESA in 2007 and ecommerce platform Jumia in 2012, the African fintech scene has become a force to be reckoned with.

Flutterwave bagging a $250m Series D round in February underlines the growing strength of the African fintech industry. The funding round came almost a year after the San Francisco and Lagos-based fintech secured a $170m Series D round in March 2021.

Since the last funding round, small businesses using Flutterwave’s solution to make cross-border payments have jumped from 290,000 to 900,000. The company is now able to process 150 currencies across different forms of payment. These include local and international cards, mobile wallets and bank transfers.

Flutterwave will use the February financial top up to its coffers to expand and further develop its fintech solutions.

Chargebee raises $250m in Series H round

Chargebee is a US and India-based payment processor startup. In February, the fintech venture secured a $250m Series H funding round at a $3.5bn valuation. That more than doubles the $1.4bn valuation it achieved after its $125m Series F funding round in April 2021.

Chargebee doubling its valuation in nine months highlights the potential of its tools and services in helping companies manage their subscription-based models and integrate with payment networks such as Stripe and PayPal.

India has emerged as a hotbed for tech unicorns. In November 2021, GlobalData said there were 45 tech unicorns in the nation, worth $138bn in total.

Amber Group nets $200m in Series B extension

Despite talks about an inbound cryptocurrency winter, fintech startup Amber Group bagged $200m in Series B+ funding round in February.

The round brought the cryptocurrency exchange’s valuation past the $3bn mark.

Temasek led the raise with participation from existing shareholders including Sequoia China, Pantera Capital, Tiger Global Management, Tru Arrow Partners, and Coinbase Ventures among others.

The round is an extension of Amber Group’s $100m Series B round from June 2021. It has now raised a total of $328m.

Michael Wu, Amber Group’s global CEO, said, “From radically transforming the concept of ownership and value in the global economy, digital assets are redefining the way we live outside of the financial ecosystem.

“At Amber Group, we want to do more than just enable mainstream digital asset adoption. We want to help create a digital future where digital assets empower people with the opportunity and agency to shape a better world for all.”

Spotter secures $200m in venture capital

Spotter is part of the wave of fintech startups aiming to make it easier for influencers to monetise their following. It is doing so by offering YouTubers large sums of money upfront in exchange for future ad revenue on their existing uploads.

In February, the fintech startup secured $200m in a Series D round led by SoftBank Vision Fund 2. Spotter is now valued at $1.7bn.

It had raised $555m in three undisclosed funding rounds prior to the Series D.

Pine Labs raises $150m in venture funding ahead of IPO

India-based Pine Labs secured $150m in February as the fintech is gearing up for a public float.

The news comes after The Economic Times reported that Pine Labs is gearing up for a US listing where it could raise up to $500m. The scaleup has reportedly filed for a confidential initial public offering (IPO) in New York with the US Securities and Exchange Commission.

Pine Labs creates application programming interfaces (APIs) enabling businesses to accept payments and manage operations.

The company is reportedly also in talks to acquire Bangalore-based API infrastructure company Setu, having previously bought fintech Face for $45m in April 2021.

Funding Societies bags $144m amidst Southeast Asian boom

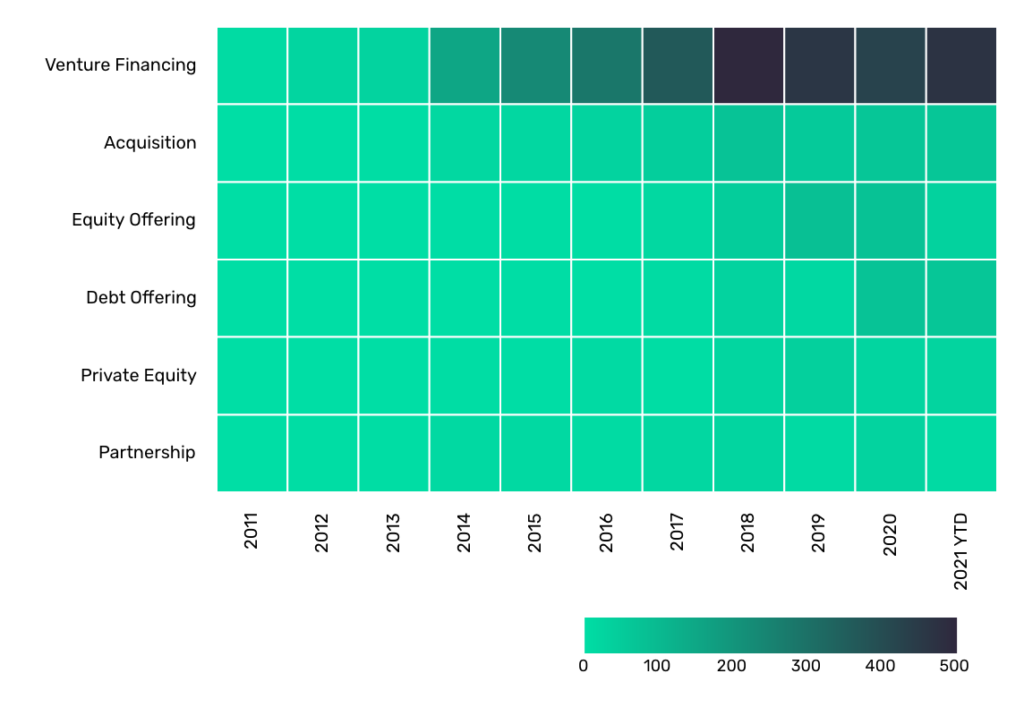

Fintech is blowing up in Southeast Asia. Data from GlobalData’s Technology Intelligence Centre reveals that the number of venture financing deals in the financial services deals in the region grew from nine in 2011 to 473 in 2021.

And it doesn’t seem as if the trend is slowing down with SME lender Funding Societies securing $144m in February, becoming the second fintech venture on this list to nab funding from SoftBank Vision Fund 2.

VNG Corporation, Rapyd Ventures, EDBI, Indies Capital, K3 Ventures and Ascend Vietnam also participated in the raise.

The digital finance platform for SMEs also bagged $150m in debt lines from institutional investors.

“SMEs across Southeast Asia have historically struggled to access institutional finance and instead been forced to mainly rely on personal funding to support growth,” Greg Moon, SoftBank Investment Advisers managing partner, told TechCrunch.

“Funding Societies is establishing a bridge for these companies to access more sustainable and cheaper financing by building unique data sets on their performance and using AI-led technology to assess their creditworthiness more effectively than traditional models.”

Fenbeitong becomes unicorn on the back of $140m Series C+

Chinese corporate spend startup Fenbeitong secured its unicorn status in February after the fintech netted $140m in a Series C+ round.

DST Global led the raise. Hillhouse, Ribbit, Stau, Glade Brook, and Bit Rock, D1 Capital Partners, WhaleRock, Saudi Aramco’s P7 Ventures and Emergence also joined the raise. Fenbeitong has now raised over $300m in total.

Fenbeitong CEO and founder Henry Lan said that the startup aims to build a one-stop shop for corporate spend. Having already inked partnerships with everything form airlines to ride sharing platforms, Lan said the round will “enable our company to ascend even further – strengthening our product capabilities, forging new markets, and expanding the visionary team.”

Alma raises $131.4m in Series C funding

French fintech startups have enjoyed a great start of 2022. In January, fintechs Qonto and PayFit became newly minted unicorns on the back of multi-million funding rounds. By doing so, they helped fulfill President Emmanuel Macron’s long-term goal that France would have 25 unicorns by 2025.

The French fintech victory lap continued in February with BNPL platform Alma securing a $131.4m Series C. The round also saw it secure debt financing worth $109m (€95m).

Cathay Innovation, Eurazeo, Bpifrance, Seaya Ventures, Picus Capital, Tencent, GR Capital and Roosh Ventures joined the raise. Alma stayed mum about its valuation.

“We strive to be an efficient and sane alternative to traditional consumer credit,” says Alma co-founder and CEO Louis Chatriotm told Fintech Futures.

The funding will enable Alma to go toe-to-toe with the likes of Klarna in France, Germany, Italy, Spain and Belgium. It also aims to launch in the Netherlands, Luxembourg, Portugal, Ireland and Austria at some point this year.

Tonik Financial secures $131m in Series B funding

Funding Societies wasn’t the only Southeast Asian company adding to the fintech boom in the region in February. Filipino challenger bank Tonik Financial, the parent company of Tonik Digital Bank, bagged $131m in a Series B equity funding round led by Japan’s Mizuho Bank last month.

The deal saw Tonik add Prosus Ventures, DST Partners co-founder Rahul Mehta, Sixteenth Street Capital and Nuri Group to its roster of backers. Existing investors Sequoia India, Point72 Ventures, Insignia, iGlobe, Alpha JWC, Citius, Blauwpark and Kraft returned to inject even more cash into the venture launched in 2021.

The digital bank will use the funding to expand its digital operation in the Philippines and drive financial inclusion in Southeast Asia. It estimates that the Philippines offers a $140bn retail savings market and a $100bn unsecured consumer loan opportunity.

Tonik founder and CEO Greg Krasnov said: “We are very excited to partner with Mizuho, one of the top 10 banking groups in the Asia-Pacific region. The partnership with Mizuho will provide Tonik with enhanced access to the international wholesale funding markets and world-class managerial talent, as well as serve as a fantastic platform for our future international expansion.”

If you and your business want to help the people of Ukraine during these terrible times, you can find information on how to do so here.

GlobalData is the parent company of Verdict and its sister publications.