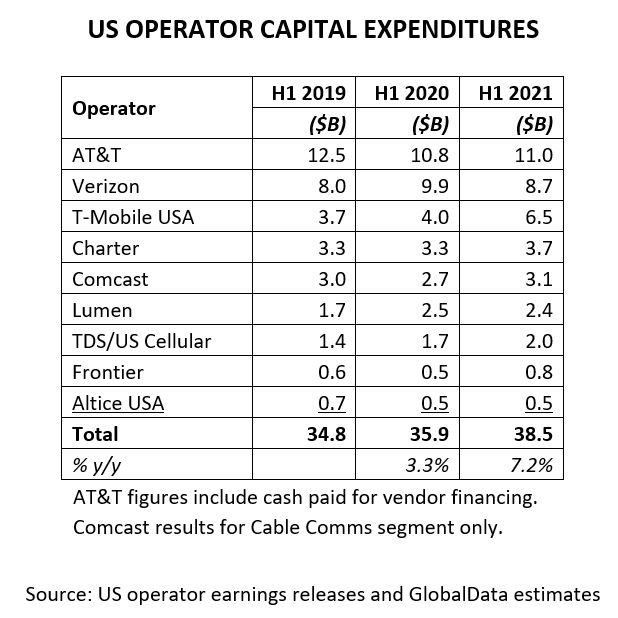

A GlobalData analysis of US telcom operator financial results based on mid-year 2021 earnings releases shows capital expenditures (CapEx) spending increased just over 7% compared to Covid-impacted H1 2020. In total, the nine publicly reported carriers spent $38.5 billion in CapEx. GlobalData estimates that the big three operators that account for nearly 70% of total US CapEx – AT&T, Verizon, and T-Mobile USA – spent just over $26 billion, up 6.1% from H1 2020.

T-Mobile was the standout among H1 2021 CapEx spenders, increasing its spend by approximately $2.5 billion compared to the prior year as it works through the buildout of its 5G network across both low-band spectrum as well as the mid-band 2.5 GHz spectrum it obtained through its acquisition of Sprint.

T-Mobile was one of a handful of operators increasing its guidance for full-year 2021. T-Mobile USA now expects to spend $12.0 billion-$12.3 billion on a full-year basis, up $300 million from previous guidance. Similarly, Frontier increased its full-year guidance by $300 million to $1.8 billion due to its plans to accelerate its buildout of fiber in 2021-2022.

Overall, most operators maintained previous guidance, while one operator, Lumen, decreased its guidance by $300 million to $3.2 billion-$3.5 billion.

Overall, US operators appear poised to post a 3%-4% increase in full-year CapEx compared to 2020 – on par with GlobalData estimates originally published in March 2021.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHowever, one operator in particular, AT&T, introduced a possible fly in the ointment. Speaking at an investor conference in August, AT&T CFO Pascal Desroches indicated that his company will likely reach only 2.5 million new homes with fiber this year compared to its previous guidance of 3 million, due to fiber supply chain issues.