Square, the payments firm run by Twitter’s Jack Dorsey, is applying for a banking license to become a new Challenger bank.

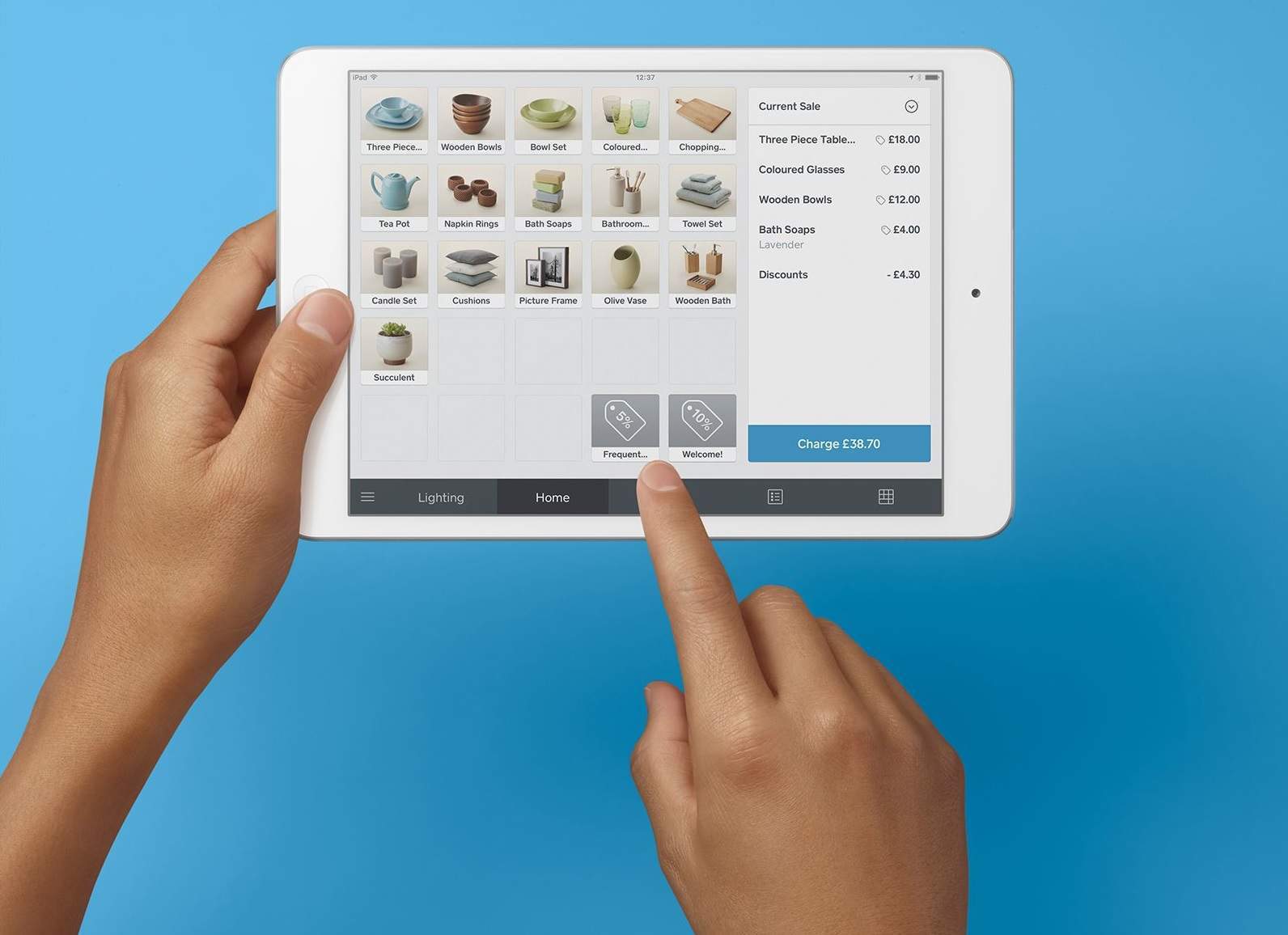

Launched in 2009, the startup developed a credit card reader that allows small business to accept payments on mobile devices, making the process wholly simpler.

Last year, Square processed $50bn in payments, across four countries: the US, Australia, Canada and Japan. It announced it was coming to the UK earlier this year.

After its success in payments, Square has grown its business loans through its lending division named Square Capital.

This is backed up by a Utah-based lender, Celtic Bank, and offers short-term loans based on merchant payments data.

Square says it has extended more than $1.8bn in credit to more than 141,000 firms this way.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataInstead of relying on another bank to offer loans, Square has instead submitted an application to form a separate bank, also based in Utah, to be called Square Financial Services.

According to the Wall Street Journal, the financial arm will offer loans and deposit accounts to small businesses.

Jacqueline Reses, head of Square Capital and soon-to-be chairman of the banking arm, said:

As we scale, it’s becoming increasingly important that we have direct relationships with regulators.

Instead of applying for a normal banking license, Square is applying for an industrial-loan company charter.

If successful, this will allow the company to offer banking services, whilst still maintaining other non-financial aspects of the business, such as food delivery through its Caviar subsidiary.

Challenger banks are all the rage now

Since the 2008 global financial crash, challenger banks have sprung up to take on the incumbents. In the UK, startups like Starling Bank and Monzo have been successful in receiving banking licenses from the UK regulators.

If Square receives its license, then it will join the likes of BankMobile and Social Finance.